Understanding California’s No-Fault Car Insurance System

California is known for its bustling highways and heavy traffic, making car accidents an unfortunate reality for many residents. To alleviate the burden of determining fault and streamline the claims process, the state has implemented a no-fault car insurance system. This article aims to shed light on this policy, how it works, and its implications for California drivers.

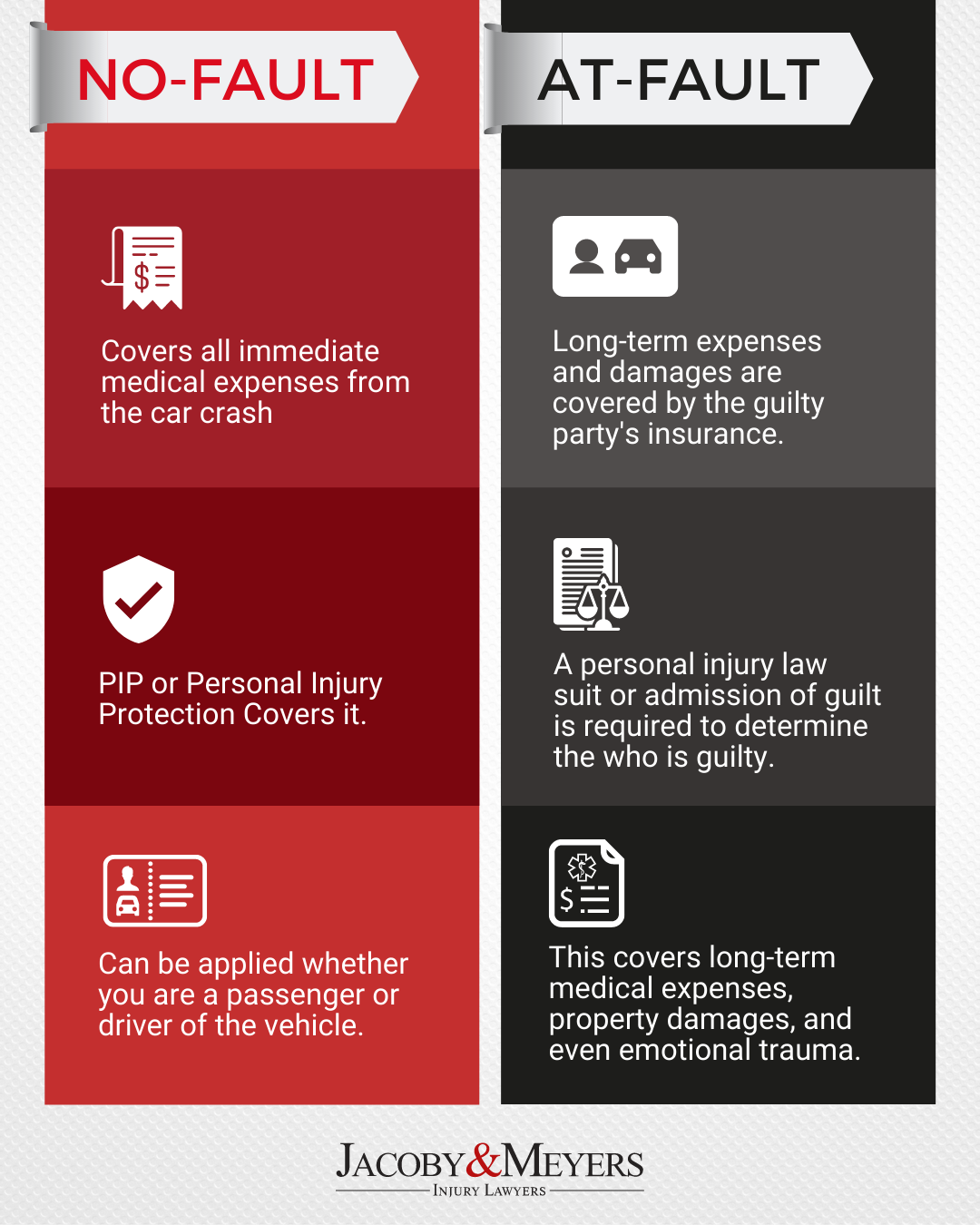

No-fault car insurance, also known as Personal Injury Protection (PIP), ensures that regardless of who caused the accident, each party’s insurance company will cover their own medical expenses and other related costs. This approach eliminates the need for lengthy investigations to determine fault, allowing individuals to quickly access the necessary coverage for their injuries.

Under the California no-fault system, all drivers are required to carry a minimum amount of PIP coverage. This coverage typically includes medical expenses, loss of income, and other related costs resulting from an accident, regardless of who was at fault. By having this coverage, drivers can seek compensation from their own insurance company without having to pursue a lawsuit against the other party involved.

While the no-fault system offers benefits such as faster claims processing and reduced legal proceedings, it also has its limitations. One major limitation is that it only covers personal injuries and related expenses, excluding property damage. To cover vehicle repairs or replacement, drivers still need to rely on traditional liability insurance or collision coverage.

Moreover, it is important to note that California’s no-fault car insurance system does not completely absolve drivers of responsibility. If a driver’s actions are found to be reckless or intentional, they may still be held liable for the accident and the resulting damages. Additionally, the no-fault system does not cover pain and suffering compensation, which is typically sought through a lawsuit.

It is worth mentioning that while California follows a no-fault system, other states may have different insurance regulations in place. Therefore, it is important for individuals to understand the specific laws and requirements of their state.

In conclusion, California’s no-fault car insurance system aims to simplify the claims process and provide prompt coverage for personal injuries resulting from car accidents. While it eliminates the need for fault determination, it does not cover property damage or pain and suffering compensation. Understanding the ins and outs of this system is crucial for all California drivers to ensure they have the appropriate coverage and know their rights in case of an accident.